Direct links in this web page

Harris & Hood Form 460 filed 10/24/02:

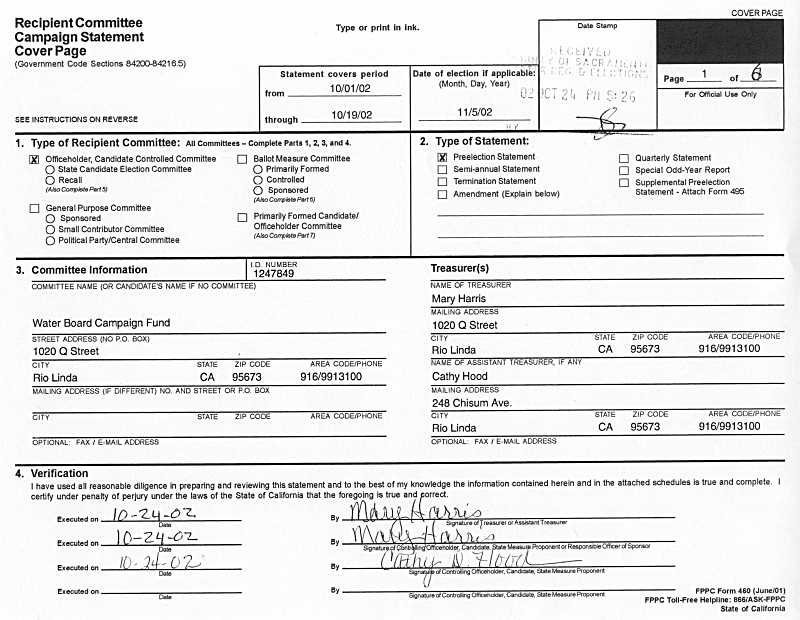

Cover Page

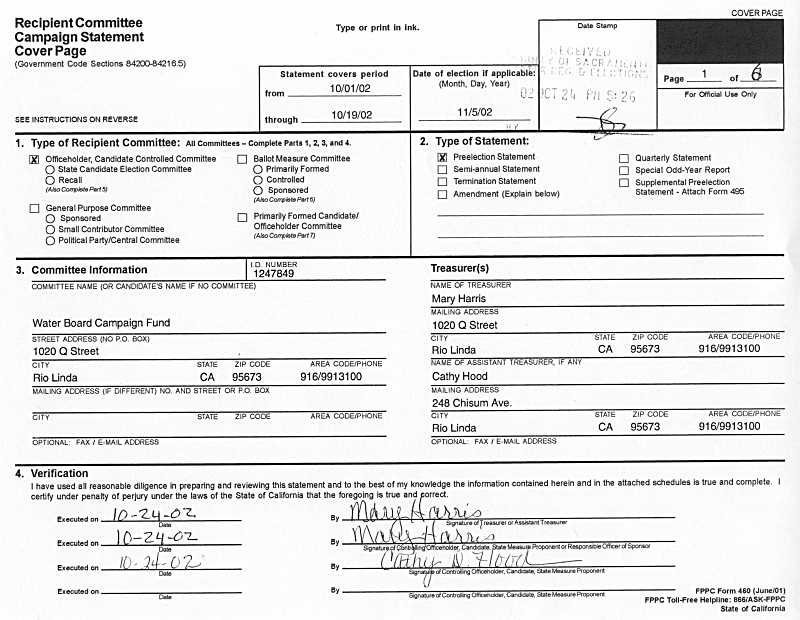

Cover Page Part 2

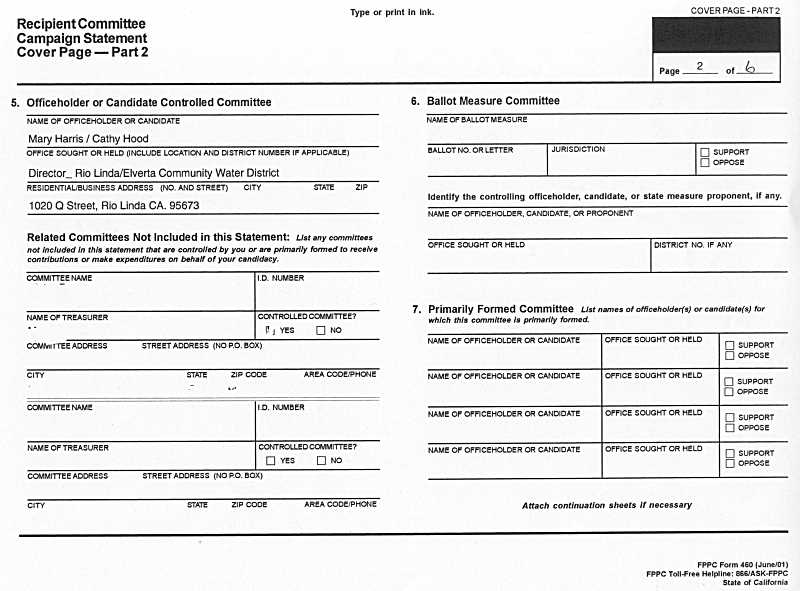

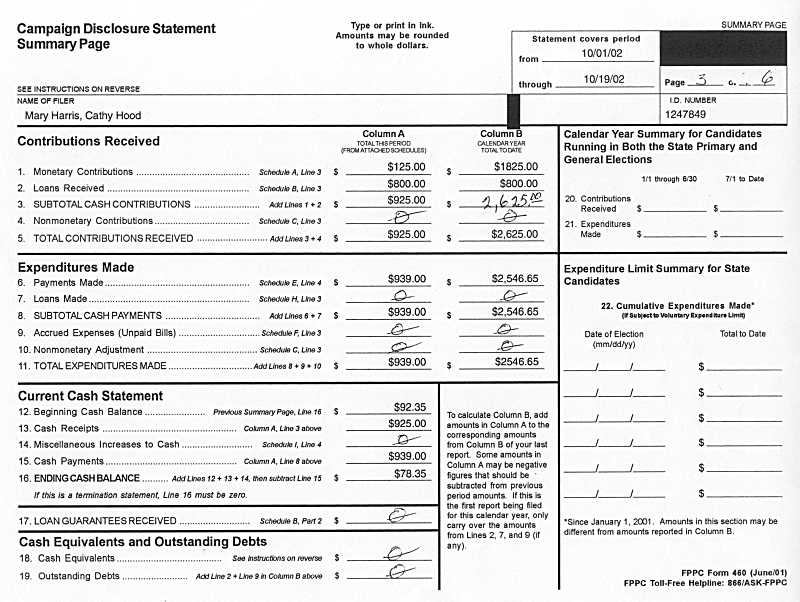

Summary Page

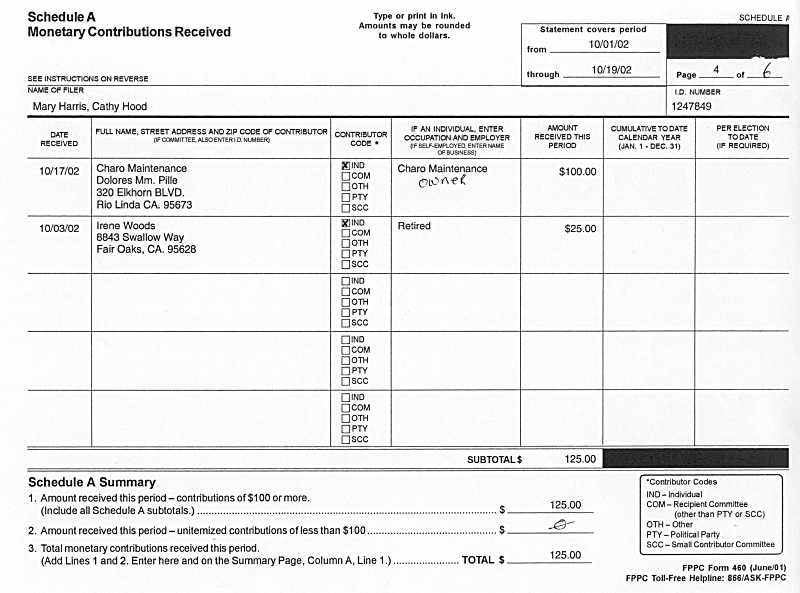

Schedule A - Contributions Received

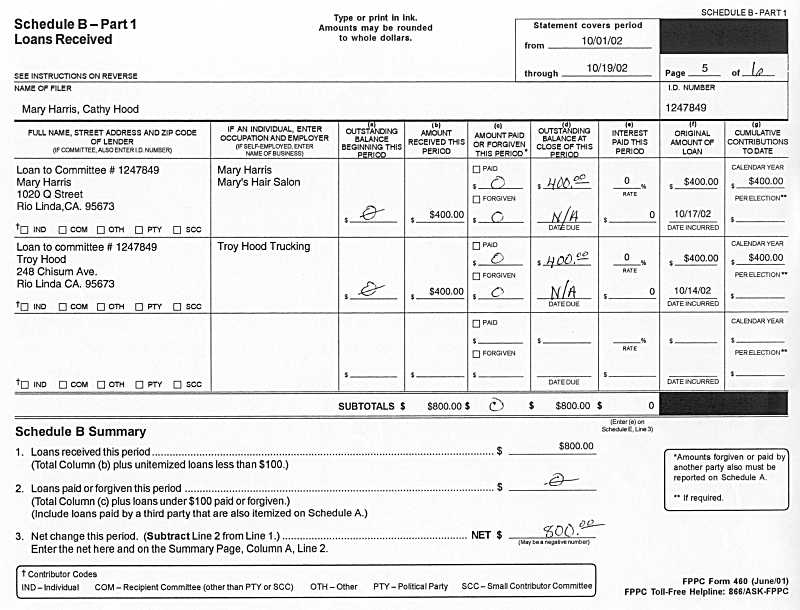

Schedule B - Loans Received

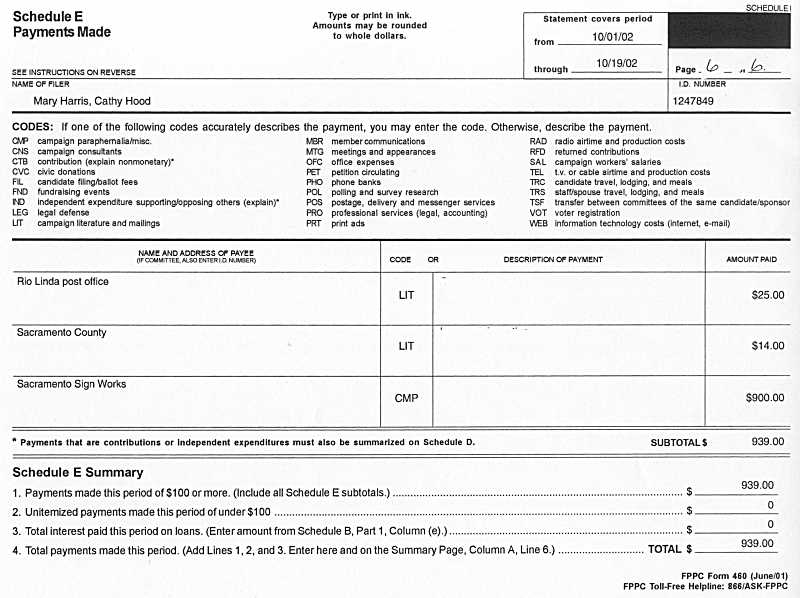

Schedule E - Payments Made

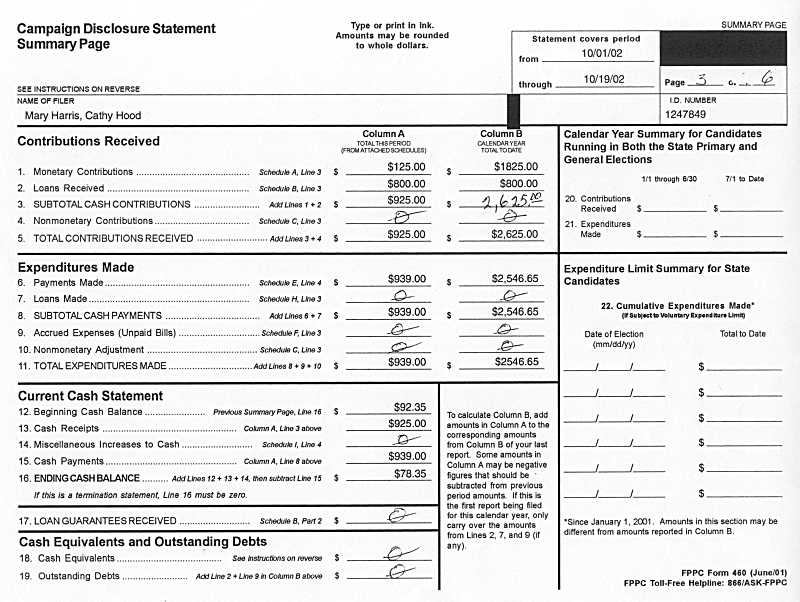

Preface

Candidates

for office who establish campaign committees must file preelection statements.

A statement covering the period October 1 - 19, 2002, was required to be

filed with the Registrar of Voters on or before October 24, 2002. Candidates

Harris and Hood filed their statement, California Form 460, on October 24

at 5:26 PM. The six pages of that statement are included below.

The source of $400 in contributions of $100 or more that was not disclosed

in their previous statement is still not divulged. It is not possible to

determine the identity (ies) of the contributor(s), thus Hood and Harris

do not comply with California Government Code §84211(f). See Schedule

A and Summary Page below.

Their previous statement identified an outstanding debt that has seemingly

vanished without explanation. This was either $460 or $560, per different

lines on their previously filed schedule F. How can a debt vanish? See Summary Page below.

The accounting reflected in the statement below, filed by candidates Harris and Hood on October 24, 2002, is not credible.

Jay O'Brien

October 26, 2002

All documents

included in this web page are public documents that were obtained from the Sacramento County Registrar of Voters per government code §81008(a). The documents

are presented here without any edit, correction or modification.

Below is the California Form 460 Cover Page.

Unlike their first Cover page,

this one has the three required signatures and follows the "Type or print

in ink" instruction at the top of the page. The County date stamp shows this

form was received on October 24, 2002, at 5:26 PM.

Below is the California Form 460 Cover Page -- Part 2.

Below is the California Form 460 Summary Page.

Column B line 1 accurately reports the sum of $1700 previously reported contributions

plus the $125 received in this period. This confirms the earlier reported

$1700 to be a valid amount as of September 30, not an error. Their previous statement did

not identify the source of $400 of "contributions of $100 or more" that was

included in the reported $1700; the source of the $400 has still not been

divulged by Hood and Harris, even though required by the election code.

Column B in the first 11 lines is intended to be a sum of what was previously

reported in Column B of their first summary plus the contributions or expenditures

between October 1 and October 19 as reported in Column A. Their first Summary

Page column B reported "0" in line 3 in error; this summary corrects for

that error without explanation.

Also without explanation, line 12 shows a Beginning Cash Balance of $92.35,

not the "0" ending cash balance as reported in their first summary.

The "Accrued Expenses" reported in their previous (first) summary

of $560.00 have disappeared. The $560 reported as unpaid bills

on September 30 has now become "0" without any accounting of the satisfaction

of that previously reported debt. The $560 was carried to their first summary

from a Schedule F, Accrued expenses (unpaid bills). Even though there was

an outstanding Schedule F balance reported on September 30, they did not

file a Schedule F to "also report the payment on Schedule F, column (c)"

as instructed by the FPPC instructions for Schedule F.

Below is the California Form 460 Schedule A - Monetary Contributions Received.

These are new contributions, and unlike their first Schedule A,

the subtotal is entered and correctly carried to line 1. Their first Schedule

A does not identify the source of $400 in contributions summarized in line

1 of their first Schedule A; this Schedule A also does not identify the previously

missing $400.

The "Cumulative to date calendar year" column is blank for both contributions, an error also present on their first Schedule A.

Below is the California Form 460 Schedule B - Loans Received.

The contributor code boxes are not checked for either lender.

Below is the California Form 460 Schedule E - Payments Made.

The address of the payees, required by §84211(k)(2), is missing for both payees.

jump to top of page

Click here to advance to part 4

Click here for the summary